Bitcoin, the highly controversial open source P2P cryptocurrency has been trending lately as it pushes closer towards the US $50,000 mark. This was spurred further by news of Elon Musk’s Tesla investing US $1.5 billion into Bitcoin. The company also announced that it is going to start accepting bitcoin as payment for its products soon. While this is likely the largest bitcoin purchase by a public company, it is certainly not the only institutional investment into cryptocurrency. While the likes of Square and MicroStrategy have already invested directly into bitcoin, financial behemoths such as Visa, PayPal and Fidelity have put their support behind the cryptocurrency. It is also noteworthy that Uber is considering Bitcoin and other cryptocurrencies as a form of payment from customers.

Bitcoin, the highly controversial open source P2P cryptocurrency has been trending lately as it pushes closer towards the US $50,000 mark. This was spurred further by news of Elon Musk’s Tesla investing US $1.5 billion into Bitcoin. The company also announced that it is going to start accepting bitcoin as payment for its products soon. While this is likely the largest bitcoin purchase by a public company, it is certainly not the only institutional investment into cryptocurrency. While the likes of Square and MicroStrategy have already invested directly into bitcoin, financial behemoths such as Visa, PayPal and Fidelity have put their support behind the cryptocurrency. It is also noteworthy that Uber is considering Bitcoin and other cryptocurrencies as a form of payment from customers.

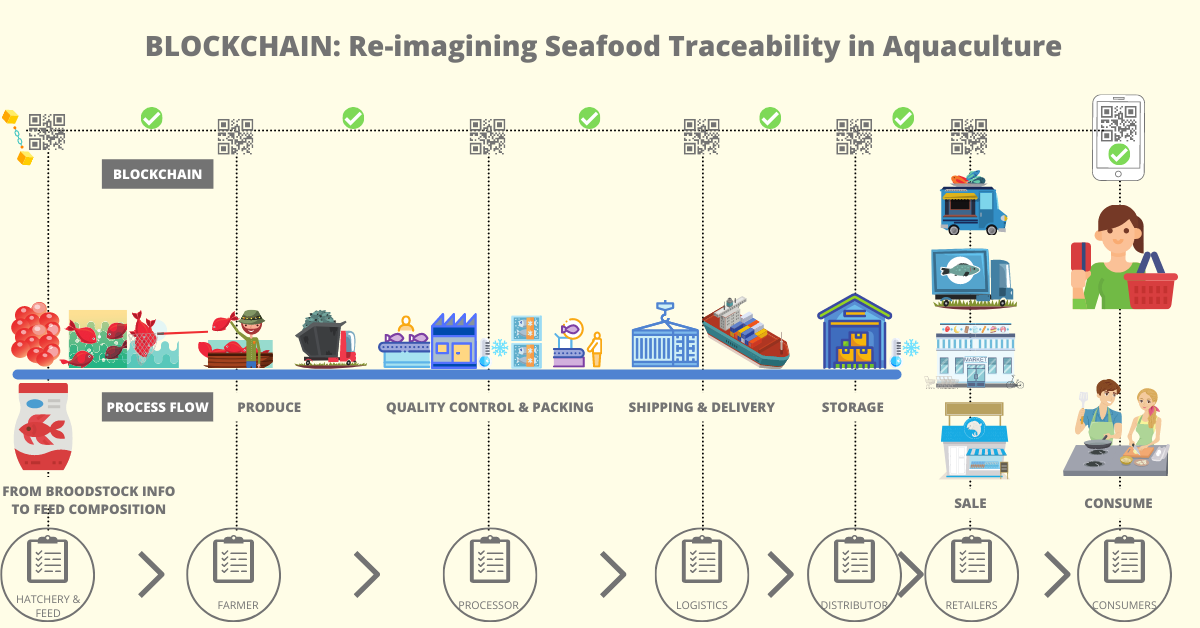

BLOCKCHAIN: Re-imagining seafood traceability in Aquaculture

While the regulatory aspects of cryptocurrencies remain unclear, what can be agreed in general is that the principles and the technologies behind cryptocurrencies are here to stay. Bitcoin was the first ever implementation of the blockchain technology, and was created on the principle of decentralising trust and authentication, in essence, bringing transparency to transactions while cutting out the middleman.

Let’s face it, just like how Internet adoption was inevitable, so is the adoption of blockchain in all applications where ‘trust’ is necessitated. Blockchain is going to be synonymous with trust. The PwC “Time for trust” report, 2020, estimates that the “Blockchain has the potential to add $1.76 trn to the global economy by 2030”, enhancing “around 40 million jobs globally”. From India’s perspective, the Ministry of Electronics & Information Technology (MeitY) has put forth recommendations to the Government to create a National Level Blockchain Framework (NLBF) to encourage the adoption of blockchain technology across a variety of public use cases. The Ministry has come out with a draft ‘National Strategy on Blockchain‘. This shows that governments are taking serious note of blockchain and related technologies and are trying to figure out ways of incorporating it into regulatory frameworks.

“Blockchain is a distributed ledger technology that empowers anyone with an internet connection to transfer data and assets frictionlessly – anywhere, anytime, with unmatched security and integrity and without relying on a third party intermediary.”1 Simplified, it is a distributed database that brings transparency and hence, accountability to transactions. All transactions are recorded, and cannot be altered without recording the changes made. And all records are permanent.

The three game-changing attributes of blockchain are security, accountability and efficiency.1 This can be implemented effectively through tokens, smart contracts, artificial intelligence and IoT. Tokens are essentially digital tokens that signify value, the most popular use of tokens is as currency such as Bitcoin. Smart contracts are self-executing, self-enforcing contracts – without intermediaries, that “can be programmed to facilitate exchanges with specific conditions executed from a blockchain”1. Artificial intelligence and IoT paired with blockchain provides “security and accountability to the machines that will increasingly guide human decision making.”1

Globally, the food industry’s biggest challenges are food waste and food fraud. If anything, the pandemic has taught us the value of basic necessities, especially food. It is estimated that one third of the food produced in the world for human consumption – i.e. approximately 1.6 billion tonnes of food is currently lost or wasted every year.

The fisheries and aquaculture sectors are recognised as the most vulnerable sectors for food fraud. From mislabeling to species substitution in processing, from diseases to use of antibiotics in farm, from tampered expiry dates to breakage in cold chain in logistics and distribution, there are several factors that makes seafood susceptible to food fraud.

Blockchain with its complimentary technologies can help combat food waste and food fraud. Complete food traceability through blockchain will bring security, accountability and efficiency in the supply chain. In addition, it will help forecast demand and prices enhancing fair trade. The system can reward good actors in the blockchain network and remove bad actors. As identities of all participants in the blockchain are already established, food safety measures can be built into the system. In essence, trust becomes second nature.

Aquaculture has the potential to imbibe the concept of ‘complete traceability’ provided by the blockchain as end-to-end information in the supply chain can be availed with the co-operative participation of all the actors concerned. This will bring transparency and reinforces trust that will enable the sector to grow at a relatively rapid pace. It can also open up avenues for new online marketplaces for international and domestic trade with online platforms having ‘trust’ as USP. Importantly, it can also help improve farmers access to institutional finance and insurance since access to crop data and previous financial performance de-risks institutions enabling them to participate in the farming side of the business. In the end, all the participants in the blockchain can benefit and the consumer can be assured of a responsibly grown, ethically sourced safe-to-eat seafood product.

Walmart, one of the world’s largest retailers, collaborated with IBM to pilot a blockchain technology project for end-to-end traceability of farmed shrimp from India for export to the USA.2 This is the first of its kind utilisation of blockchain technology to track shrimp exports from the farmer to an overseas retailer.2 This is a good example of how blockchain technology can be used to improve Indian aquaculture industry’s credibility in the global market. We hope and welcome more solution-oriented blockchain-based technology initiatives to the aquaculture industry that can help India achieve its fish production target of 22 million metic tons with a sustained annual growth rate of about 9% and export earnings of about Rs.1,00,000 crores by 2024-25 as outlined in the Pradhan Mantri Matsya Sampada Yojana (PMMSY)3.